FIRE Belgium

Learn to take control of your finances and invest better

so that you can live more and give more.

FIRE Belgium is here to help you build financial security and pursue financial independence through education and the power of community.

Learn to take control of your finances and invest better

so that you can live more and give more.

FIRE Belgium is here to help you build financial security and pursue financial independence through education and the power of community.

FIRE Belgium is a personal finance education business and community based in Belgium.

We are here to help you build financial security and financial freedom, one step at a time.

We use simple and effective methods to take control of our finances and progress towards Financial Independence and Early Retirement (FIRE).

Here is what you can learn here:

You’re financially independent when you have enough wealth or passive income to pay for your living expenses for the rest of your life. You don’t need to to work for money and you don’t depend on others financially.

While often presented as a goal, financial independence is a journey.

Most people start by being highly dependent on their job (or on others) for income. As you learn to take control of your finances, you gradually build financial security and then financial freedom in your life up. Step by step you improve your financial situation until the point where have the choice to quit your job without having to worry about money.

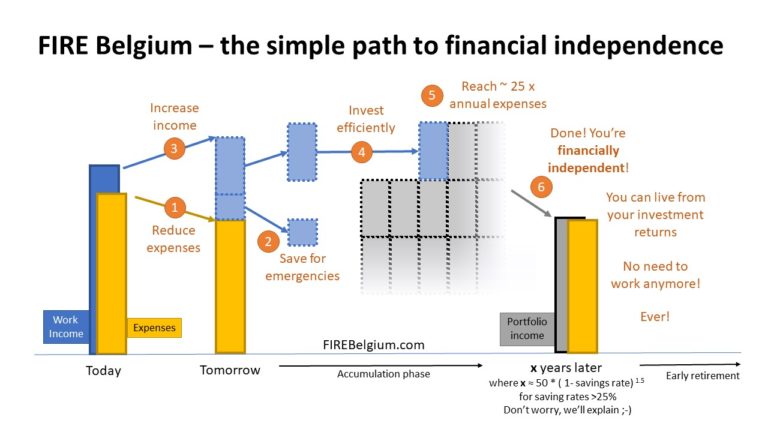

Here is a simple diagram showing a common way to achieve financial independence.

This is a technical description of a process almost anyone can implement. It does not require you to be an investment professional or launch the next Netflix. This is a simple process you can follow:

1. Reduce expenses: it’s NOT about depriving yourself and cutting out everything (like the media often presents it), it’s about spending money on what you value in an efficient way. Reducing expenses is often the easiest and quickest way to boost our savings. Optimizing your spending can help you build some financial security fast!

2. Save for emergencies: this is so that you have a buffer for when something unexpected (and expensive) happens. This is your first line of defense (social security is part of your defense too).

3.Increase income: This is the other way of increasing your savings. It’s usually harder to do but it’s well worth spending time figuring this out. While there is a limit on how much you can cut your spending, there isn’t one on how much you can earn (provided you are willing to learn and work for it).

4. Invest efficiently: This is an essential part of the FIRE approach. You want your savings to work hard for you, in a way that is sustainable in the long term and that matches your risk capacity. Here we like index investing because it’s probably the most efficient way to build wealth completely passively. .

5. Reach 25 x annual expenses: This is based on the 4% guideline often used in the FIRE community. It’s just a guideline which needs to be adapted to your personal situation (age, other sources of income, pension, social security, etc.).

6. You’re financially independent! This is when you do not depend on your job income to pay for your living expenses. You can live off the returns of your investments, doing minimal work. When you’re FIRE, you can choose what to do with your time, without money being a major constraints. You can choose to travel, enjoy your hobbies, spend time with your loved ones, start a passion project or you can choose to continue to work. The goal is for you to find what brings you fulfillment (and doing nothing rarely achieves that :-))

At FIRE Belgium, we believe money and financial independence are great tools to building a fulfilling life. We see investing and financial independence as enablers for good. With increased control on our finances, we create choice and opportunities in our lives. And with increased financial security, all the way to financial independence, we unlock superpowers that can help make the world a better place.

We believe this simple knowledge is for everyone to benefit from, and we aim to bring it to everyone in Belgium.

Index investing is probably the simplest and most efficient way to invest and benefit from compound growth over the long term.

It’s an approach that is based on evidence and academic research that leads to better performance than what the vast majority of investment professionals can achieve. It has been developed by investors like you and me, to serve investors like you and me. It’s based on a set solid principles and is much simpler to learn and implement than what the financial industry wants you to believe (of course thay would rather you rely on (and pay) them. But the truth is, you’re often much better off, skipping their investment advice and investing through 1 or 2 index funds and holding them long term. All the research show that this is the most efficient way to get the best results over the long term at minimal cost.

To learn more about index investing, we recommend you read our Beginner’s Guide to Index Investing and participate in the Index Investing for Beginners Workshop.

Learn how to create passive income from the stock market using index funds, ETFs or trackers, without having to pay high fees to banks or advisors, taking unnecessary risks or spending all day analyzing the markets.

Join a group of like-minded people. Ask questions, share your experience. Together we can do so much more

And if you’re not on Facebook, you can always join our Meetup group.

What does it take to reach financial independence? What mindset shifts (sacrifices?) do you need to make? And how do you invest to create reliable passive income?

The basic concepts of FIRE and 3 case studies of people pursuing FI in Belgium

The power of index investing and of the FI community in Belgium

Sebastien Aguilar, Founder of FIRE Belgium

In 2015, Sebastien founded SimplyFI, an organisation that helps promote financial literacy among expats in the United Arab Emirates. He has helped thousands of people take better control of their finance and start investing wisely for the long term. His talks on “How to plan for financial independence” were very popular. Thanks to the help of an amazing team, SimplyFI is now a community of more than 18,000 people, helping each other with their personal finances.

In 2019, Sebastien moved to Belgium and founded FIRE Belgium with the goal to share this simple yet life-changing knowledge of investing with everyone in Belgium.

Sebastien has been featured several times in UAE newspaper The National, more recently in Le Vif Weekend in Belgium and on many podcasts.

Sebastien is not a finance professional (because you don’t need to be one to be invest wisely). He does not provide financial advice. Everything he shares is based on public information and is for educational and entertainment purpose only.

His background is in energy consulting and engineering. He used to lead a consulting team of senior experts in the fields of sustainable development and renewable energy. He has worked with the United Nations, advised government entities in the UAE and Saudi Arabia and presented to some of their ministers.

I have helped many people start investing or review their plan to achieve financial independence. Some of them even reached financial independence before me as a result!

So, if you are looking for someone to speak at a conference or company learning event, I would be happy to help. My talks are engaging, easy to understand and tailored to the audience.

And if you need personalized help beyond the meetups and events that FIRE Belgium organizes, I am also available for coaching in person or via video-conference.

Simply drop me an email at “hello@firebelgium.com”.

Disclaimer: I am not a financial advisor. I don’t give regulated investment, tax or legal advice. I will not try to sell you anything nor get any commission from any products. I don’t give product recommendations and I don’t hold money to invest it on behalf of other people. You are solely responsible for any decision you may take as a result of our coaching sessions.